Lots of people are speculating whether we’re headed for a recession. John Hussman notes that historically recessions are not officially called until long after they happen. That means we won’t know until way after the fact when or if a recession happens. We could already be in the beginning of a recession, or we might not have one at all, we won’t know for sure until later.

Recessions are part of a normal boom and bust economic cycle. The economy does well, everyone rushes in and stock prices go up, everyone is building and spending. But at some point company profits hit a wall, consumers have already bought what they want. The cost of doing business keeps going up, but companies can’t make the profits they used to. Finally stock prices go up well past the current value of the companies behind them, and investors realize that prices have gotten too high and the economy is not as healthy as it was. Everyone starts to lighten up, sell stock, get out. There are layoffs, jobs are hard to find, people can't sell their houses. That pushes prices down, eventually way below the real values of the companies, with stock prices overshooting on the down side, just as they did on the up side. The economy looks terrible, and eventually pessimism is so low that nobody wants to invest. But finally, eventually, people slowly start spending and investing again, starting the whole cycle over. The down part of that boom and bust cycle is a recession.

Correctly anticipating recessions is a pretty big deal when making investment decisions. Investments that do well in good times can do terribly in recessions. And many of the biggest drops in the value of stocks and other investments occur when the stock market sees anything that looks like an imminent recession. But other investments do extremely well in recessions, so having some idea where we are in the economic cycle is important.

How can I tell if we are in or close to a recession? Economists have a collection of leading and trailing indicators that they watch. The leading indicators are things that should change early, providing an early warning system of economic trouble. The trailing indicators will change later, and are mostly useful to confirm what has already happened. The Fed watches all of them as a part of their job to keep monetary systems working smoothly if the economy is in trouble.

There is a lot to watch, but Michael Kantrowitz has simplified it by reducing dozens of leading indicators down to four key indicators that he calls the HOPE framework (Housing, Orders, Profits, Employment). In his opinion, you can see each of these four things fall before a recession, one by one, with employment being the last thing to fall, the final indicator that a recession is here or imminent.

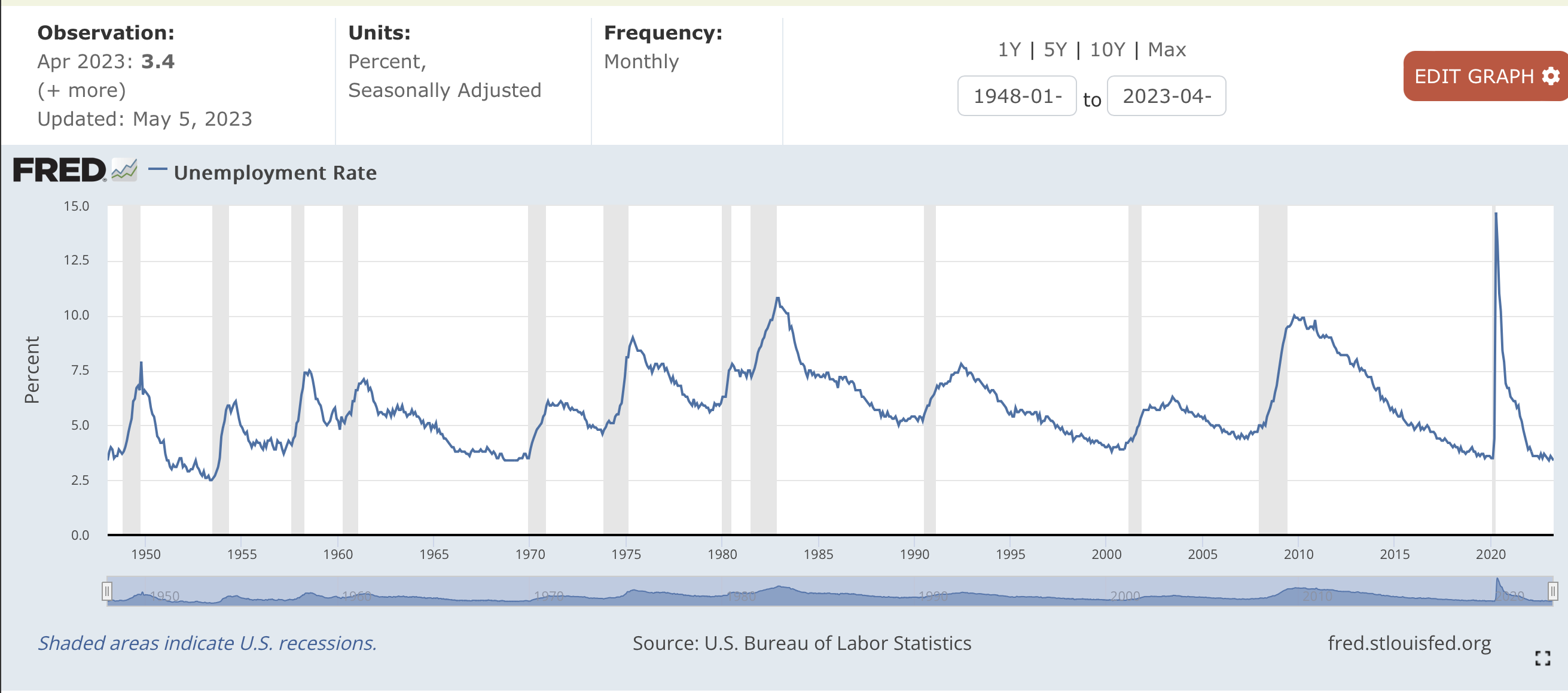

So far the unemployment rate is still historically low, but that does not mean there is no recession coming, nor that a recession is far in the future. John Hussman points out that an increase in unemployment is the very last thing that happens before a recession begins, and sometimes doesn’t happen until the economy is already in recession. Here is a the graph produced by the Fed which shows the history of the unemployment rate as compared to periods of recession. This graph shows that unemployment is extremely low at the beginning of every recession and doesn’t get high until well into the recession.

One thing that can push the economy into recession is high interest rates. High interest rates make it expensive for companies to invest and build and hire. The Fed seems to be focused on the low unemployment rate as a key reason to keep hiking interest rates, but high interest rates are likely to cause a recession, and we may not see unemployment drop until we’re already in one. The outcome of causing a recession is actually expected, and a recession is one of the best and most reliable ways of reducing inflation. All the talk of a "soft landing" is about whether inflation will drop before the higher interest rates cause a recession, or at least that a recession will be mild.

But if unemployment won't increase until the recession has begun, and the Fed won't quit hiking rates until unemployment goes up, recession feels inevitable.